TBILL_YIELD Function

Evaluates the yield of a Treasury bill.

Usage

result = TBILL_YIELD (settlement, maturity, price)

Input Parameters

settlement—The date on which payment is made to settle a trade. For a more detailed discussion on dates see Chapter 8, Working with Date/Time Data in the PV‑WAVE User Guide.

maturity—The date on which the bond comes due, and principal and accrued interest are paid. For a more detailed discussion on dates see Chapter 8, Working with Date/Time Data in the PV‑WAVE User Guide.

price—Price per $100 face value of the Treasury bill.

Returned Value

result—The yield for a Treasury bill. If no result can be computed, NaN is returned.

Input Keywords

Double—If present and nonzero, double precision is used.

Discussion

Function TBILL_YIELD computes the yield for a Treasury bill.

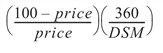

It is computed using the following:

In the equation above, DSM represents the number of days in the period starting with the settlement date and ending with the maturity date (any maturity date that is more than one calendar year after the settlement date is excluded).

Example

In this example, TBILL_YIELD computes the yield for a Treasury bill with the settlement date of July 1, 2000, the maturity date of July 1, 2001, and priced at $94.93.

settlement = VAR_TO_DT(2000, 7, 1)

maturity = VAR_TO_DT(2001, 7, 1)

price = 94.93

PRINT, TBILL_YIELD(settlement, maturity, price)

; PV-WAVE prints: 0.0526762