PRESENT_VALUE Function

Evaluates the net present value of a stream of equal periodic cash flows, which are subject to a given discount rate.

Usage

result = PRESENT_VALUE(rate, n_periods, payment, future_value, when)

Input Parameters

rate—Interest rate.

n_periods—Total number of periods.

payment—Payment made in each period.

future_value—The value, at some time in the future, of a current amount and a stream of payments.

when—Time in each period when the payment is made, either 0 for at the end of period or 1 for at the beginning of period.

Returned Value

result—The present value of an investment. If no result can be computed, NaN is returned.

Input Keywords

Double—If present and nonzero, double precision is used.

Discussion

Function PRESENT_VALUE computes the present value of an investment.

If rate = 0:

present_value + (payment)(n_periods) + future_value = 0

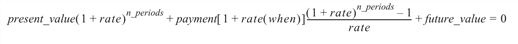

If rate ¹ 0:

Example

In this example, PRESENT_VALUE computes the present value of 20 payments of $500,000 per payment ($10 million) with an annual interest rate of 6%. The payment is made at the end of each period.

PRINT, PRESENT_VALUE(0.06, 20, 500000., 0., 0)

; PV-WAVE prints: -5.73496e+06