NET_PRES_VALUE Function

Evaluates the net present value of a stream of unequal periodic cash flows, which are subject to a given discount rate.

Usage

result = NET_PRES_VALUE (rate, values)

Input Parameters

rate—Interest rate per period.

values—One-dimensional array of equally-spaced cash flows.

Returned Value

result—The net present value of an investment. If no result can be computed, NaN is returned.

Input Keywords

Double—If present and nonzero, double precision is used.

Discussion

Function NET_PRES_VALUE computes the net present value of an investment. Net present value is the current value of a stream of payments, after discounting the payments using some interest rate.

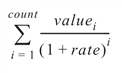

It is found by solving the following with count = N_ELEMENTS (values):

where valuei = the ith cash flow.

Example

In this example, NET_PRES_VALUE computes the net present value of a $10 million prize paid in 20 years ($500,000 per year) with an annual interest rate of 6%.

rate = 0.06

value = FLTARR(20)

value(*) = 500000.

PRINT, NET_PRES_VALUE(rate, value)

; PV-WAVE prints: 5.73496e+06