INT_RATE_SCHD Function

Evaluates the internal rate of return for a schedule of cash flows. It is not necessary that the cash flows be periodic.

Usage

result = INT_RATE_SCHD (values, dates)

Input Parameters

values—One-dimensional array of cash flows, which includes the initial investment.

dates—One-dimensional array of dates cash flows are made. For a more detailed discussion on dates see Chapter 8, Working with Date/Time Data in the PV‑WAVE User Guide.

Returned Value

result—The internal rate of return for a schedule of cash flows that is not necessarily periodic. If no result can be computed, NaN is returned.

Input Keywords

Double—If present and nonzero, double precision is used.

Xguess—If present, the initial value of the internal rate of return.

Highest—If present, the value is used as the maximum value of the internal rate of return allowed.

Discussion

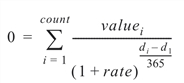

Function INT_RATE_SCHD computes the internal rate of return for a schedule of cash flows that is not necessarily periodic. The internal rate such that the stream of payments has a net present value of zero.

It can be found from the following with count = N_ELEMENTS (values):

In the equation above, di represents the ith payment date. d1 represents the 1st payment date. valuei represents the ith cash flow. rate is the internal rate of return.

Example

In this example, INT_RATE_SCHD computes the internal rate of return for nine cash flows, $-800, $800, $800, $600, $600, $800, $800, $700 and $3,000, with an initial investment of $4,500.

years = [1998, 1998, 1999, 2000, 2001, 2002, 2003, 2004, $

2005, 2006]

months = [1, 10, 5, 5, 6, 7, 8, 9, 10, 11]

days = [1, 1, 5, 5, 1, 1, 30, 15, 15, 1]

dates = VAR_TO_DT(years, months, days)

v = [-4500., -800, 800, 800., 600., 600, 800, 800, 700, 3000]

PRINT, INT_RATE_SCHD(v, dates)

; PV-WAVE prints: 0.0768996