INT_RATE_ANNUITY Function

Evaluates the interest rate per period of an annuity.

Usage

result = INT_RATE_ANNUITY(n_periods, payment, present_value, future_value, when)

Input Parameters

n_periods—Total number of periods.

payment—Payment made each period.

present_value—The current value of a stream of future payments, after

discounting the payments using some interest rate.

future_value—The value, at some time in the future, of a current amount and a stream of payments.

when—Time in each period when the payment is made, either 0 for at the end of period or 1 for at the beginning of period.

Returned Value

result—The interest rate per period of an annuity. If no result can be computed, NaN is returned.

Input Keywords

Double—If present and nonzero, double precision is used.

Xguess—If present, the value is used as the initial guess at the interest rate.

Highest—If present, the value is used as the maximum value of the interest rate allowed.

Discussion

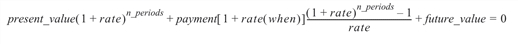

Function INT_RATE_ANNUITY computes the interest rate per period of an annuity. An annuity is a security that pays a fixed amount at equally spaced intervals. It can be found by solving the following:

If rate = 0:

present_value + (payment)(n_periods) + future_value = 0

If rate ¹ 0:

Example

In this example, INT_RATE_ANNUITY computes the interest rate of a $20,000 loan that requires 70 payments of $350 to pay off the loan.

PRINT, 12*INT_RATE_ANNUITY(70, -350, 20000, 0, 1)

; PV-WAVE prints: 0.0734519