DURATION_MAC Function

Evaluates the modified Macauley duration of a security.

Usage

result = DURATION_MAC(settlement, maturity, coupon_rate, yield, frequency, basis)

Input Parameters

settlement—The date on which payment is made to settle a trade. For a more detailed discussion on dates see Chapter 8, Working with Date/Time Data in the .

maturity—The date on which the bond comes due, and principal and accrued interest are paid. For a more detailed discussion on dates see Chapter 8, Working with Date/Time Data in the .

coupon_rate—Annual interest rate set forth on the face of the security; the coupon rate.

yield—Annual yield of the security.

frequency—Frequency of the interest payments. It should be 1, 2, or 4.

basis—The method for computing the number of days between two dates. It should be 0, 1, 2, 3, or 4.

Returned Value

result—The modified Macauley duration of a security is returned. The security has an assumed par value of $100. If no result can be computed, NaN is returned.

Input Keywords

Double—If present and nonzero, double precision is used.

Discussion

Function DURATION_MAC computes the modified Macauley duration for a security with an assumed par value of $100.

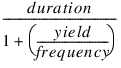

It is computed using the following:

where duration is calculated from the function DURATION.

Example

In this example, DURATION_MAC computes the modified Macauley duration of a security with the settlement date of July 1, 1995, and maturity date of July 1, 2005, using the Actual/365 day count method.

settlement = VAR_TO_DT(1995, 7, 1)

maturity = VAR_TO_DT(2005, 7, 1)

coupon = .075

yield = .09

frequency = 2

basis = 3

PRINT, DURATION_MAC(settlement, maturity, coupon, yield, $

frequency, basis)

; PV-WAVE prints: 6.73871