iflag | Computed coefficient | |

–1 |  | |

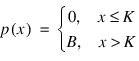

0 | p(x) | |

1 | σ | |

2 | μ | |

3 | κ |

iflag | Computed coefficient | |

–1 |  | |

0 | p(x) | |

1 | σ | |

2 | μ | |

3 | κ |

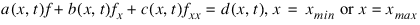

iflag | Computed boundary conditions | |

1 | Left end, x = xmin | |

2 | Right end, x = xmax |

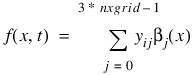

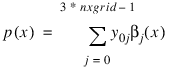

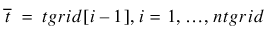

for t = tgrid(i–1), i = 1, ..., ntgrid.

for t = tgrid(i–1), i = 1, ..., ntgrid.

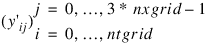

for

for

for

for

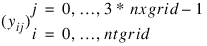

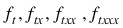

at time point t=tgrid(i–1), i=1, ..., ntgrid and row 0 for the partials at t=0.

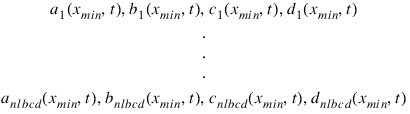

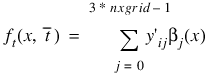

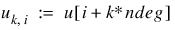

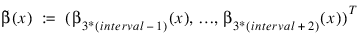

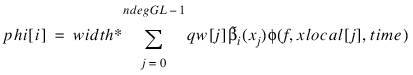

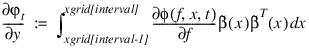

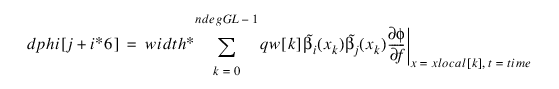

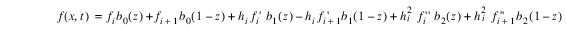

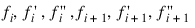

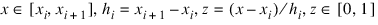

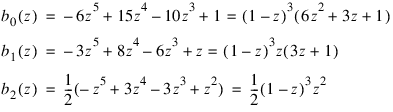

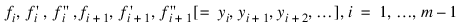

at time point t=tgrid(i–1), i=1, ..., ntgrid and row 0 for the partials at t=0. at the Gauss-Legendre points xlocal. Setting

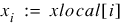

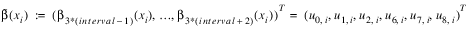

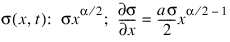

at the Gauss-Legendre points xlocal. Setting and

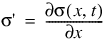

and  ,

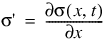

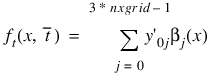

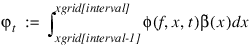

,  is defined as:

is defined as:

i | time dependence of variable |

0 | σ' |

1 | σ |

2 | μ |

3 | κ |

4 | Left boundary conditions |

5 | Right boundary conditions |

6 | φ |

i | Entry in istate |

0 | Mass Matrix, M |

1 | Stiffness matrix, N |

2 | Bending matrix, R |

3 | Weighted mass, K |

4 | Left boundary condition data |

5 | Right boundary condition data |

6 | Forcing term |

i | nval(i) |

0 | Number of residual function evaluations of the DAE used in the model. |

1 | Number of factorizations of the differential matrix associated with solving the DAE. |

2 | Number of linear system solve steps using the differential matrix. |

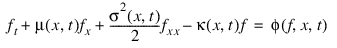

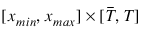

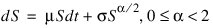

, etc. The FEYNMAN_KAC function uses a finite element Galerkin method over the rectangle:

, etc. The FEYNMAN_KAC function uses a finite element Galerkin method over the rectangle:

; These routines define the coefficients, payoff, boundary

; conditions and forcing term for American and European

; Options.

FUNCTION fkcfiv_put, x, tx, iflag, value

; The sigma value.

sigma=0.4

; Value of the interest rate and continuous dividend.

strike_price=10.0

interest_rate=0.1

dividend=0.0

zero=0.0

CASE iflag OF

0:BEGIN

; The payoff function.

value = MAX([strike_price - x, zero])

END

-1:BEGIN

; The coefficient derivative dsigma/dx.

value = sigma

END

1:BEGIN

; The coefficient sigma(x).

value = sigma*x

END

2:BEGIN

; The coefficient mu(x).

value = (interest_rate - dividend) * x

END

3:BEGIN

; The coefficient kappa(x).

value = interest_rate

END

ENDCASE

; Note that there is no time dependence.

iflag = 0L

RETURN,1

END

FUNCTION fkbcp_put, nbc, tx, iflag, val

CASE iflag OF

1:BEGIN

val(*) = 0.0

val(1) = 1.0

val(3) = -1.0

val(6) = 1.0

END

2:BEGIN

val(*) = 0.0

val(0) = 1.0

val(5) = 1.0

val(10) = 1.0

END

ENDCASE

; Note no time dependence.

iflag = 0

RETURN,1

END

FUNCTION fkforce_put, interval, ndeg, nxgrid, $

y, time, width, xlocal, $

qw, u, phi, dphi

COMMON f_kac_usr, usr_data

local=6

yl = FLTARR(local)

bf = FLTARR(local)

zero=0.0

one=1.0

index = INDGEN(local)

data = usr_data

yl = y(3*interval-3 + index)

phi(*) = zero

strike_price = data(0)

interest_rate = data(1)

value = data(2)

mu=2.0

; This is the local definition of the forcing term.

FOR j=1L, local DO BEGIN

FOR l=1L, ndeg DO BEGIN

bf(0) = u((l-1))

bf(1) = u((l-1)+ndeg)

bf(2) = u((l-1)+2*ndeg)

bf(3) = u((l-1)+6*ndeg)

bf(4) = u((l-1)+7*ndeg)

bf(5) = u((l-1)+8*ndeg)

rt = SUM(yl * bf)

rt = value/(rt + value - (strike_price-xlocal(l-1)))

phi(j-1) = phi(j-1) + (qw(l-1) * bf(j-1) * rt^mu)

ENDFOR

ENDFOR

phi = -phi * width*interest_rate*strike_price

; This is the local derivative matrix for the forcing term.

dphi(*) = zero

FOR j=1L, local DO BEGIN

FOR i=1L, local DO BEGIN

FOR l=1L, ndeg DO BEGIN

bf(0) = u((l-1))

bf(1) = u((l-1)+ndeg)

bf(2) = u((l-1)+2*ndeg)

bf(3) = u((l-1)+6*ndeg)

bf(4) = u((l-1)+7*ndeg)

bf(5) = u((l-1)+8*ndeg)

rt = SUM(yl * bf)

rt = one/(rt + value-(strike_price-xlocal(l-1)))

dphi(i-1+(j-1)*local) = dphi(i-1+(j-1)*local) + $

qw(l-1) * bf(i-1) * bf(j-1) $

* (rt^(mu+1.0))

ENDFOR

ENDFOR

ENDFOR

FOR i=0L, (local*local)-1 DO BEGIN

dphi(i) = mu * dphi(i) * width * value^mu * $

interest_rate * strike_price

ENDFOR

RETURN,1

END

PRO feynman_kac_ex1

; Compute American Option Premium for Vanilla Put.

COMMON f_kac_usr, usr_data

NXGRD = 61

NTGRD = 2

NV = 9

; The strike price.

KS = 10.0

; The sigma value.

sigma = 0.4

; Time values for the options.

nt = 2

time = [ 0.25, 0.5]

; Values of the underlying where evaluations are made.

xs = [ 0.0, 2.0, 4.0, 6.0, 8.0, 10.0, $

12.0, 14.0, 16.0 ]

; Value of the interest rate.

r = 0.1

; Values of the min and max underlying values modeled.

x_min=0.0

x_max=30.0

; Define parameters for the integration step.

nint=NXGRD-1

n=3*NXGRD

xgrid = FLTARR(NXGRD)

ye = FLTARR((NTGRD+1),3*NXGRD)

yeprime = FLTARR((NTGRD+1),3*NXGRD)

ya = FLTARR((NTGRD+1),3*NXGRD)

yaprime = FLTARR((NTGRD+1),3*NXGRD)

fe = FLTARR(NTGRD*NV)

fa = FLTARR(NTGRD*NV)

dx = 0.0

nlbcd = 2

nrbcd = 3

atol = 0.2e-2

; Array for user-defined data.

usr_data = FLTARR(3)

; Define an equally-spaced grid of points for the

; underlying price.

;

; Determine the increment between points (to be used later...)

dx = (x_max-x_min)/ nint

; Create the grid.

xgrid = INTERPOL([x_min,x_max], NXGRD)

Atol_Rtol = [ 0.5e-2, 0.5e-2 ]

; Set up the user data in the COMMON block for the user

; function(s).

usr_data = [KS, r, atol]

ret = FEYNMAN_KAC(nlbcd, nrbcd, xgrid, time, $

"fkcfiv_put", "fkbcp_put", ye, yeprime, $

ScalarAtolRtol=Atol_Rtol)

ret = FEYNMAN_KAC(nlbcd, nrbcd, xgrid, time, $

"fkcfiv_put", "fkbcp_put", ya, $

yaprime, Fcn_force="fkforce_put" , $

ScalarAtolRtol=Atol_Rtol)

; Evaluate solutions at vector of points XS(:), at each

; time value prior to expiration.

FOR i=0L, nt-1 DO BEGIN

fe(i*NV:(i*NV)+NV-1) = FEYNMAN_KAC_EVALUATE(xgrid, $

xs, ye((i+1),*))

fa(i*NV:(i*NV)+NV-1) = FEYNMAN_KAC_EVALUATE(xgrid, xs, $

ya((i+1),*))

ENDFOR

PRINT,'American Option Premium for Vanilla Put, ' + $

'3 and 6 Months Prior to Expiry'

PRINT," Number of equally spaced spline knots: ", NXGRD

PRINT," Number of unknowns: ", n

PRINT," Strike=",KS," sigma=",sigma," Interest Rate=",r

PRINT,""

PRINT,"Underlying European American"

FOR i=0L, NV-1 DO BEGIN

PRINT, xs(i), fe(i), fe(i+NV), fa(i), fa(i+NV), $

format='(5(f10.4))'

ENDFOR

PRINT,""

END

American Option Premium for Vanilla Put, 3 and 6 Months Prior to Expiry

Number of equally spaced spline knots: 61

Number of unknowns: 183

Strike= 10.0000, sigma= 0.400000, Interest Rate= 0.100000

Underlying European American

0.0000 9.7536 9.5134 10.0000 10.0000

2.0000 7.7537 7.5135 8.0000 8.0000

4.0000 5.7538 5.5150 6.0000 6.0000

6.0000 3.7619 3.5664 4.0000 4.0000

8.0000 1.9073 1.9170 2.0146 2.0880

10.0000 0.6518 0.8579 0.6768 0.9042

12.0000 0.1628 0.3392 0.1679 0.3526

14.0000 0.0374 0.1271 0.0374 0.1321

16.0000 0.0091 0.0477 0.0085 0.0499

FUNCTION fcn_fkcfiv, x, tx, iflag, value

COMMON f_kac_usr, usr_data

zero=0.0

half=0.5

data = usr_data

strike_price = data(0)

sigma = data(2)

alpha = data(3)

interest_rate = data(4)

dividend = data(5)

CASE iflag OF

0:BEGIN

; The payoff function.

value = (x - strike_price)>zero

END

-1:BEGIN

; The coefficient derivative d sigma/ dx.

value = half * alpha * sigma * x^(alpha*half-1.0)

END

1:BEGIN

; The coefficient sigma(x).

value = sigma * x^(alpha*half)

END

2:BEGIN

; The coefficient mu(x).

value = (interest_rate - dividend) * x

END

3:BEGIN

; The coefficient kappa(x).

value = interest_rate

END

ENDCASE

; Note that there is no time dependence.

iflag = 0

RETURN,1

END

FUNCTION fcn_fkbcp, nbc, tx, iflag, val

COMMON f_kac_usr, usr_data

data = usr_data

strike_price = data(0)

x_max = data(1)

interest_rate = data(4)

CASE iflag OF

1:BEGIN

val(*) = 0.0

val(0) = 1.0

val(5) = 1.0

val(10) = 1.0

; Note no time dependence at left end.

iflag = 0

END

2:BEGIN

df = EXP(interest_rate*tx)

val(*) = 0.0

val(0) = 1.0

val(3) = x_max - df*strike_price

val(5) = 1.0

val(7) = 1.0

val(10) = 1.0

END

ENDCASE

RETURN,1

END

PRO t_feynman_kac_ex2

COMMON f_kac_usr, usr_data

NXGRD = 121l

NTGRD = 3l

NV = 3l

; Compute Constant Elasticity of Variance Model for Vanilla Call

; The set of strike prices.

KS= [ 15.0, 20.0, 25.0]

; The set of sigma values.

sigma = [ 0.2, 0.3, 0.4]

; The set of model diffusion powers.

alpha = [2.0, 1.0, 0.0]

; Time values for the options.

nt = NTGRD

time = [ 1.0/12.0, 4.0/12.0, 7.0/12.0 ]

; Values of the underlying where evaluations are made.

xs = [ 19.0, 20.0, 21.0 ]

; Value of the interest rate and continuous dividend.

r=0.05

dividend=0.0

; Values of the min and max underlying values modeled.

x_min=0.0

x_max=60.0

; Define parameters for the integration step.

nint = NXGRD-1

n = 3*NXGRD

xgrid = FLTARR(NXGRD)

y = FLTARR((NTGRD+1)*3*NXGRD)

yprime = FLTARR((NTGRD+1)*3*NXGRD)

f = FLTARR(NTGRD*NV)

dx = 0.0

; Number of left/right boundary conditions.

nlbcd = 3L

nrbcd = 3L

usr_data = FLTARR(6)

; Define equally-spaced grid of points for the underlying price.

xgrid = INTERPOL([x_min,x_max], NXGRD)

PRINT,"Constant Elasticity of Variance Model for Vanilla Call"

PRINT,"Interest Rate: ",r," Continuous Dividend: ", dividend

PRINT,"Minimum and Maximum Prices of Underlying: ", $

STRING(x_min,Format="(f6.2)"), " ",$

STRING(x_max ,Format="(f6.2)")

PRINT,"Number of equally spaced spline knots:",NXGRD-1

PRINT,"Number of unknowns:",n

PRINT,""

PRINT,"Time in Years Prior to Expiration: ", $

STRING(time(0),Format="(f7.4)"), " ",$

STRING(time(1),Format="(f7.4)"), " ",$

STRING(time(2),Format="(f7.4)")

PRINT,"Option valued at Underlying Prices: ", $

STRING(xs(0),Format="(f5.2)"), " ",$

STRING(xs(1),Format="(f5.2)"), " ",$

STRING(xs(2),Format="(f5.2)")

PRINT,""

FOR i1=1L, 3 DO BEGIN ; Loop over power.

FOR i2=1L, 3 DO BEGIN ; Loop over volatility.

FOR i3=1L, 3 DO BEGIN ; Loop over strike price.

; Pass data through into evaluation routines.

usr_data(0) = KS(i3-1)

usr_data(1) = x_max

usr_data(2) = sigma(i2-1)

usr_data(3) = alpha(i1-1)

usr_data(4) = r

usr_data(5) = dividend

ret = FEYNMAN_KAC(nlbcd, nrbcd, xgrid, time, $

"fcn_fkcfiv", "fcn_fkbcp", y, yprime)

; Evaluate solution at vector of points xs, at each

; time Value prior to expiration.

FOR i=0L, NTGRD-1 DO $

f(i*NV:(i*NV)+NV-1) = $

FEYNMAN_KAC_EVALUATE(xgrid, xs, REFORM(y((i+1),*)))

outstr = "Strike="+STRING(KS(i3-1),Format="(f6.2)")+ $

" Sigma="+STRING(sigma(i2-1),Format="(f6.2)")+ $

" Alpha="+STRING(alpha(i1-1),Format="(f6.2)")

PRINT, outstr

FOR i=0L, NV-1 DO BEGIN

outstr = " Call Option Values "+ $

STRING(f(i),Format="(f7.4)") + " "+ $

STRING(f(NV+i),Format="(f7.4)") + " "+ $

STRING(f(2*NV+i),Format="(f7.4)")

PRINT, outstr

ENDFOR

ENDFOR

ENDFOR

ENDFOR

END

Constant Elasticity of Variance Model for Vanilla Call

Interest Rate: 0.0500000 Continuous Dividend: 0.00000

Minimum and Maximum Prices of Underlying: 0.00 60.00

Number of equally spaced spline knots: 120

Number of unknowns: 363

Time in Years Prior to Expiration: 0.0833 0.3333 0.5833

Option valued at Underlying Prices: 19.00 20.00 21.00

Strike= 15.00 Sigma= 0.20 Alpha= 2.00

Call Option Values 4.0624 4.2575 4.4729

Call Option Values 5.0624 5.2506 5.4490

Call Option Values 6.0624 6.2486 6.4385

Strike= 20.00 Sigma= 0.20 Alpha= 2.00

Call Option Values 0.1310 0.5956 0.9698

Call Option Values 0.5029 1.0889 1.5100

Call Option Values 1.1980 1.7484 2.1751

Strike= 25.00 Sigma= 0.20 Alpha= 2.00

Call Option Values 0.0000 0.0113 0.0744

Call Option Values 0.0000 0.0373 0.1615

Call Option Values 0.0007 0.1026 0.3132

Strike= 15.00 Sigma= 0.30 Alpha= 2.00

Call Option Values 4.0639 4.3397 4.6618

Call Option Values 5.0626 5.2945 5.5783

Call Option Values 6.0624 6.2709 6.5238

Strike= 20.00 Sigma= 0.30 Alpha= 2.00

Call Option Values 0.3109 1.0275 1.5500

Call Option Values 0.7323 1.5422 2.1024

Call Option Values 1.3765 2.1690 2.7385

Strike= 25.00 Sigma= 0.30 Alpha= 2.00

Call Option Values 0.0006 0.1111 0.3542

Call Option Values 0.0037 0.2169 0.5547

Call Option Values 0.0182 0.3857 0.8222

Strike= 15.00 Sigma= 0.40 Alpha= 2.00

Call Option Values 4.0755 4.5138 4.9674

Call Option Values 5.0661 5.4201 5.8324

Call Option Values 6.0634 6.3578 6.7298

Strike= 20.00 Sigma= 0.40 Alpha= 2.00

Call Option Values 0.5116 1.4645 2.1292

Call Option Values 0.9623 1.9957 2.6951

Call Option Values 1.5815 2.6110 3.3236

Strike= 25.00 Sigma= 0.40 Alpha= 2.00

Call Option Values 0.0083 0.3284 0.7785

Call Option Values 0.0284 0.5165 1.0654

Call Option Values 0.0812 0.7686 1.4104

Strike= 15.00 Sigma= 0.20 Alpha= 1.00

Call Option Values 4.0624 4.2479 4.4312

Call Option Values 5.0624 5.2479 5.4312

Call Option Values 6.0624 6.2479 6.4312

Strike= 20.00 Sigma= 0.20 Alpha= 1.00

Call Option Values 0.0000 0.0226 0.1049

Call Option Values 0.1495 0.4107 0.6485

Call Option Values 1.0832 1.3314 1.5773

Strike= 25.00 Sigma= 0.20 Alpha= 1.00

Call Option Values 0.0000 -0.0000 0.0000

Call Option Values -0.0000 -0.0000 0.0000

Call Option Values -0.0000 0.0000 0.0000

Strike= 15.00 Sigma= 0.30 Alpha= 1.00

Call Option Values 4.0624 4.2479 4.4312

Call Option Values 5.0624 5.2479 5.4312

Call Option Values 6.0624 6.2479 6.4312

Strike= 20.00 Sigma= 0.30 Alpha= 1.00

Call Option Values 0.0016 0.0785 0.2204

Call Option Values 0.1979 0.4997 0.7541

Call Option Values 1.0836 1.3443 1.6022

Strike= 25.00 Sigma= 0.30 Alpha= 1.00

Call Option Values -0.0000 0.0000 0.0000

Call Option Values -0.0000 0.0000 0.0000

Call Option Values -0.0000 0.0000 0.0005

Strike= 15.00 Sigma= 0.40 Alpha= 1.00

Call Option Values 4.0624 4.2477 4.4310

Call Option Values 5.0624 5.2477 5.4309

Call Option Values 6.0624 6.2477 6.4309

Strike= 20.00 Sigma= 0.40 Alpha= 1.00

Call Option Values 0.0084 0.1542 0.3443

Call Option Values 0.2482 0.5943 0.8729

Call Option Values 1.0871 1.3790 1.6584

Strike= 25.00 Sigma= 0.40 Alpha= 1.00

Call Option Values 0.0000 0.0000 0.0001

Call Option Values 0.0000 0.0000 0.0008

Call Option Values 0.0000 0.0004 0.0066

Strike= 15.00 Sigma= 0.20 Alpha= 0.00

Call Option Values 4.0627 4.2478 4.4312

Call Option Values 5.0623 5.2479 5.4311

Call Option Values 6.0623 6.2479 6.4312

Strike= 20.00 Sigma= 0.20 Alpha= 0.00

Call Option Values 0.0001 0.0001 0.0002

Call Option Values 0.0816 0.3316 0.5748

Call Option Values 1.0818 1.3308 1.5748

Strike= 25.00 Sigma= 0.20 Alpha= 0.00

Call Option Values 0.0000 -0.0000 -0.0000

Call Option Values 0.0000 -0.0000 -0.0000

Call Option Values -0.0000 0.0000 -0.0000

Strike= 15.00 Sigma= 0.30 Alpha= 0.00

Call Option Values 4.0625 4.2479 4.4312

Call Option Values 5.0623 5.2479 5.4312

Call Option Values 6.0624 6.2479 6.4312

Strike= 20.00 Sigma= 0.30 Alpha= 0.00

Call Option Values 0.0000 -0.0000 0.0029

Call Option Values 0.0895 0.3326 0.5753

Call Option Values 1.0826 1.3306 1.5749

Strike= 25.00 Sigma= 0.30 Alpha= 0.00

Call Option Values 0.0000 -0.0000 0.0000

Call Option Values 0.0000 -0.0000 -0.0000

Call Option Values 0.0000 -0.0000 -0.0000

Strike= 15.00 Sigma= 0.40 Alpha= 0.00

Call Option Values 4.0624 4.2479 4.4312

Call Option Values 5.0623 5.2479 5.4312

Call Option Values 6.0624 6.2479 6.4312

Strike= 20.00 Sigma= 0.40 Alpha= 0.00

Call Option Values -0.0000 0.0001 0.0111

Call Option Values 0.0985 0.3383 0.5781

Call Option Values 1.0830 1.3306 1.5749

Strike= 25.00 Sigma= 0.40 Alpha= 0.00

Call Option Values 0.0000 0.0000 0.0000

Call Option Values 0.0000 -0.0000 0.0000

Call Option Values 0.0000 -0.0000 0.0000

PRO t_feynman_kac_ex3

COMMON f_kac_usr, usr_data

NXGRD = 61l

NTGRD = 2l

NV = 12l

; The strike price.

KS1 = 10.0

; The spread value.

KS2 = 15.0

; The Bet for the Cash-or-Nothing Call.

bet = 2.0

; The sigma value.

sigma = 0.4

; Time values for the options.

time = [0.25, 0.5]

; Values of the underlying where evaluations are made.

xs = FLTARR(NV)

; Value of the interest rate and continuous dividend.

r = 0.1

dividend=0.0

; Values of the min and max underlying values modeled.

x_min=0.0

x_max=30.0

; Define parameters for the integration step.

nint = NXGRD-1

n = 3*NXGRD

xgrid = FLTARR(NXGRD)

yb = FLTARR((NTGRD+1)*3*NXGRD)

ybprime = FLTARR((NTGRD+1)*3*NXGRD)

yv = FLTARR((NTGRD+1)*3*NXGRD)

yvprime = FLTARR((NTGRD+1)*3*NXGRD)

fb = FLTARR(NTGRD*NV)

fv = FLTARR(NTGRD*NV)

; Number of left/right boundary conditions.

nlbcd = 3l

nrbcd = 3l

; Structure for the evaluation routines.

usr_data = { , $idope:I32ARR(1), $

rdope:FLTARR(7) $

}

; Define an equally-spaced grid of points for the underlying

; price.

xgrid = INTERPOL([x_min, x_max], NXGRD)

tmp = FINDGEN(NV)

xs = 2.0+(tmp*2.0)

usr_data.rdope(0) = KS1

usr_data.rdope(1) = bet

usr_data.rdope(2) = KS2

usr_data.rdope(3) = x_max

usr_data.rdope(4) = sigma

usr_data.rdope(5) = r

usr_data.rdope(6) = dividend

; Flag the difference in payoff functions

; 1 for the Bet, 2 for the Vertical Spread.

usr_data.idope(0) = 1

ret = FEYNMAN_KAC(nlbcd, nrbcd, $

xgrid, time, "fkcfiv_call", $

"fkbcp_call", yb, ybprime)

usr_data.idope(0) = 2

ret = FEYNMAN_KAC(nlbcd, nrbcd, $

xgrid, time, "fkcfiv_call",$

"fkbcp_call", yv, yvprime)

; Evaluate solutions at vector of points XS(:), at

; each time value prior to expiration.

FOR i=0L, NTGRD-1 DO BEGIN

fb(i*NV:(i*NV)+NV-1) = FEYNMAN_KAC_EVALUATE(xgrid, $

xs, REFORM(yb((i+1),*)))

fv(i*NV:(i*NV)+NV-1) = FEYNMAN_KAC_EVALUATE(xgrid, $

xs, REFORM(yv((i+1),*)))

ENDFOR

PRINT,""

PRINT,"European Option Value for A Bet"

PRINT," and a Vertical Spread, 3 and 6 Months Prior to Expiry"

PRINT," Number of equally spaced spline knots: ", $

STRTRIM(NXGRD,2)

PRINT," Number of unknowns: ",STRTRIM(n,2)

PRINT," Strike=", STRING(KS1,Format="(f5.2)"),$

" Sigma=",STRING(sigma,Format="(f5.2)"),$

" Interest Rate=",STRING(r,Format="(f5.2)")

PRINT," Bet=",STRING(bet,Format="(f5.2)"), $

" Spread Value= ",STRING(KS2,Format="(f5.2)")

PRINT,""

PRINT," Underlying A Bet Vertical Spread

FOR i=0L, NV-1 DO BEGIN

PRINT," ",STRING(xs(i),Format="(f9.4)")," ", $

STRING(fb(i),Format="(f9.4)"), " ",$

STRING(fb(i+NV),Format="(f9.4)")," ",$

STRING(fv(i),Format="(f9.4)"), " ",$

STRING(fv(i+NV),Format="(f9.4)")

ENDFOR

END

; These routines define the coefficients, payoff, boundary

; conditions and forcing term for American and European Options.

FUNCTION fkcfiv_call, x, tx, iflag, value

COMMON f_kac_usr, usr_data

zero=0.0

data = usr_data

data_real = data.rdope

data_int = data.idope

strike_price = data_real(0)

bet = data_real(1)

spread = data_real(2)

sigma = data_real(4)

interest_rate = data_real(5)

dividend = data_real(6)

CASE iflag OF

0:BEGIN

; The payoff function - Use flag passed to decide which.

CASE data_int(0) OF

1:BEGIN

; After reaching the strike price the payoff

; jumps from zero to the bet value.

value = zero

IF (x GT strike_price) THEN value = bet

END

2:BEGIN

; Function is zero up to strike price.

; Then linear between strike price and spread.

; Then has constant value Spread-Strike Price

; after the value Spread.

value = ((x-strike_price)>zero) - (x-spread>zero)

END

ENDCASE

END

-1:BEGIN

; The coefficient derivative d sigma/ dx.

value = sigma

END

1:BEGIN

; The coefficient sigma(x).

value = sigma*x

END

2:BEGIN

; The coefficient mu(x).

value = (interest_rate - dividend)*x

END

3:BEGIN

; The coefficient kappa(x).

value = interest_rate

END

ENDCASE

; Note that there is no time dependence.

iflag = 0

RETURN,1

END

FUNCTION fkbcp_call, nbc, tx, iflag, val

COMMON f_kac_usr, usr_data

data = usr_data

data_int = data.idope

data_real = data.rdope

strike_price = data_real(0)

bet = data_real(1)

spread = data_real(2)

interest_rate = data_real(5)

CASE iflag OF

1:BEGIN

val(*) = 0.0

val(0) = 1.0

val(5) = 1.0

val(10) = 1.0

; Note no time dependence in case (1) for IFLAG.

iflag = 0

END

2:BEGIN

; This is the discount factor using the risk-free

; interest rate.

df = EXP(interest_rate*tx)

; Use flag passed to decide on boundary condition.

CASE data_int(0) OF

1:BEGIN

val(*) = 0.0

val(0) = 1.0

val(3) = bet*df

END

2:BEGIN

val(*) = 0.0

val(0) = 1.0

val(3) = (spread-strike_price)*df

END

ENDCASE

val(5) = 1.0

val(10) = 1.0

END

ENDCASE

RETURN,1

END

European Option Value for A Bet and a Vertical Spread, 3 and 6 Months Prior to Expiry Number of equally spaced spline knots: 61 Number of unknowns: 183 Strike=10.00 Sigma= 0.40 Interest Rate= 0.10 Bet= 2.00 Spread Value= 15.00 Underlying A Bet Vertical Spread 2.0000 0.0000 0.0000 0.0000 0.0000 4.0000 0.0000 0.0014 0.0000 0.0006 6.0000 0.0110 0.0722 0.0039 0.0447 8.0000 0.2691 0.4305 0.1479 0.3831 10.0000 0.9948 0.9781 0.8909 1.1927 12.0000 1.6094 1.4287 2.1911 2.2273 14.0000 1.8655 1.6923 3.4254 3.1552 16.0000 1.9337 1.8177 4.2263 3.8263 18.0000 1.9476 1.8700 4.6264 4.2492 20.0000 1.9501 1.8903 4.7911 4.4921 22.0000 1.9505 1.8979 4.8497 4.6231 24.0000 1.9506 1.9007 4.8684 4.6909PRO t_feynman_kac_ex4

COMMON f_kac_usr, usr_data

; Compute value of a Convertible Bond.

NXGRD = 61

NTGRD = 2

NV = 13

; The face value.

KS = 1.0e0

; The sigma or volatility value.

sigma = 0.25e0

; Time values for the options.

time = [ 0.5, 1.0 ]

; Values of the underlying where evaluation are made.

xs = FLTARR(NV)

; Value of the interest rate, continuous dividend and factor.

r = 0.1

dividend=0.02

factor = 1.125

; Values of the min and max underlying values modeled.

x_min = 0.0

x_max = 4.0

; Define parameters for the integration step.

nint = NXGRD-1

n = 3*NXGRD

xgrid = FLTARR(NXGRD)

y = FLTARR((NTGRD+1)*3*NXGRD)

yprime = FLTARR((NTGRD+1)*3*NXGRD)

f = FLTARR((NTGRD+1)*NV)

; Array for user-defined data.

usr_data = FLTARR(8)

; Number of left/right boundary conditions.

nlbcd = 3l

nrbcd = 3l

; Define an equally-spaced grid of points for the

; underlying price.

dx = (x_max-x_min)/(nint)

xgrid = INTERPOL([x_min, x_max], NXGRD)

tmp = FINDGEN(NV)

xs = tmp*0.25

; Pass the data for evaluation.

usr_data(0) = KS

usr_data(1) = x_max

usr_data(2) = sigma

usr_data(3) = r

usr_data(4) = dividend

usr_data(5) = factor

; Use a pure absolute error tolerance for the integration.

atol = 1.0e-3

usr_data(6) = atol

; Compute value of convertible bond.

ret = FEYNMAN_KAC(nlbcd, nrbcd, xgrid, time, $

"fkcfiv_cbond", "fkbcp_cbond", y, yprime, $

Fcn_fkinit="fkinit_cbond", $

Fcn_force="fkforce_cbond", $

ScalarAtolRtol=[1.0e-3, 0.0e0] )

; Evaluate and display solutions at vector of points XS(:),

; at each time value prior to expiration.

FOR i=0L, NTGRD DO BEGIN

f(i*NV:(i*NV)+NV-1) = FEYNMAN_KAC_EVALUATE (xgrid, xs, REFORM(y(i,*)))

ENDFOR

PRINT,"Convertible Bond Value, 0+, 6 and 12 Months Prior"+ $

" to Expiry"

PRINT," Number of equally spaced spline knots: ", $

STRTRIM(NXGRD,2)

PRINT," Number of unknowns:",STRTRIM(n,2)

PRINT," Strike= ",STRING(KS,Format="(f5.2)"), $

" Sigma= ",STRING(sigma,Format="(f5.2)")

PRINT," Interest Rate= ",STRING(r,Format="(f5.2)"), $

" Dividend= ",STRING(dividend,Format="(f5.2)"), $

" Factor= ",STRING(factor,Format="(f6.3)")

PRINT,""

PRINT,"Underlying Bond Value"

FOR i=0L, NV-1 DO BEGIN

PRINT," ",STRING(xs(i),Format="(f8.4)")," ", $

STRING(f(i),Format="(f8.4)")," ", $

STRING(f(i+NV),Format="(f8.4)")," ", $

STRING(f(i+2*NV),Format="(f8.4)")

ENDFOR

END

; These routines define the coefficients, payoff,

; boundary conditions and forcing term.

FUNCTION fkcfiv_cbond, x, tx, iflag, value

COMMON f_kac_usr, usr_data

zero=0.0

data = usr_data

strike_price = data(0)

sigma = data(2)

interest_rate = data(3)

dividend = data(4)

factor = data(5)

CASE iflag OF

0:BEGIN

; The payoff function.

value = (factor * x)>strike_price

END

-1:BEGIN

; The coefficient derivative d sigma/ dx.

value = sigma

END

1:BEGIN

; The coefficient sigma(x).

value = sigma*x

END

2:BEGIN

; The coefficient mu(x).

value = (interest_rate - dividend) * x

END

3:BEGIN

; The coefficient kappa(x).

value = interest_rate

END

ENDCASE

; Note that there is no time dependence.

iflag = 0

RETURN,1

END

FUNCTION fkbcp_cbond, nbc, tx, iflag, val

COMMON f_kac_usr, usr_data

data = usr_data

CASE iflag OF

1:BEGIN

strike_price = data(0)

interest_rate = data(3)

dp = strike_price * EXP(tx*interest_rate)

val(*) = 0.0

val(0) = 1.0

val(3) = dp

val(5) = 1.0

val(10) = 1.0

END

2:BEGIN

x_max = data(1)

factor = data(5)

val(*) = 0.0

val(0) = 1.0

val(3) = factor*x_max

val(5) = 1.0

val(7) = factor

val(10) = 1.0

; Note no time dependence.

iflag = 0

END

ENDCASE

RETURN,1

END

FUNCTION fkforce_cbond, interval, ndeg, nxgrid, y, $

time, width, xlocal, qw, $

u, phi, dphi

COMMON f_kac_usr, usr_data

local=6

yl = FLTARR(local)

bf = FLTARR(local)

zero=0.e0

one=1.0e0

data = usr_data

phi(*) = zero

dphi(*) = zero

yl = y((3*interval)-3+INDGEN(local))

value = data(6)

strike_price = data(0)

interest_rate = data(3)

factor = data(5)

mu = 2.0

; This is the local definition of the forcing term.

; It "forces" the constraint f >= factor*x.

FOR j=1L, local DO BEGIN

FOR l=1L, ndeg DO BEGIN

bf(0) = u((l-1))

bf(1) = u((l-1)+ndeg)

bf(2) = u((l-1)+2*ndeg)

bf(3) = u((l-1)+6*ndeg)

bf(4) = u((l-1)+7*ndeg)

bf(5) = u((l-1)+8*ndeg)

rt = SUM(yl * bf)

rt = value/(rt + value - factor * xlocal(l-1))

phi(j-1) = phi(j-1) + qw(l-1) * bf(j-1) * rt^mu

ENDFOR

ENDFOR

phi = (-phi)*width*factor*strike_price

; This is the local derivative matrix for the forcing term

FOR j=1L, local DO BEGIN

FOR i=1L, local DO BEGIN

FOR l=1L, ndeg DO BEGIN

bf(0) = u((l-1))

bf(1) = u((l-1)+ndeg)

bf(2) = u((l-1)+2*ndeg)

bf(3) = u((l-1)+6*ndeg)

bf(4) = u((l-1)+7*ndeg)

bf(5) = u((l-1)+8*ndeg)

rt = SUM(yl * bf)

rt = one/(rt + value - factor * xlocal(l-1))

dphi(i-1+(j-1)*local) = $

dphi(i-1+(j-1)*local)+qw(l-1) * bf(i-1) * $

bf(j-1) * ((value*rt)^mu) * rt

ENDFOR

ENDFOR

ENDFOR

dphi = dphi *(-mu) * width * factor * strike_price

RETURN,1

END

FUNCTION fkinit_cbond, nxgrid, ntgrid, xgrid, tgrid, $

time, yprime, y, atol, rtol

COMMON f_kac_usr, usr_data

data = usr_data

IF time EQ 0.0 THEN BEGIN

; Set initial data precisely.

FOR i=1L, nxgrid DO BEGIN

IF (xgrid(i-1) * data(5)) LT data(0) THEN BEGIN

y(3*i-3) = data(0)

y(3*i-2) = 0.0

y(3*i-1) = 0.0

ENDIF ELSE BEGIN

y(3*i-3) = xgrid(i-1) * data(5)

y(3*i-2) = data(5)

y(3*i-1) = 0.0

ENDELSE

ENDFOR

ENDIF

RETURN,1

END

Convertible Bond Value, 0+, 6 and 12 Months Prior to Expiry

Number of equally spaced spline knots: 61

Number of unknowns:183

Strike= 1.00 Sigma= 0.25

Interest Rate= 0.10 Dividend= 0.02 Factor= 1.125

Underlying Bond Value

0.0000 1.0000 0.9512 0.9048

0.2500 1.0000 0.9512 0.9049

0.5000 1.0000 0.9513 0.9065

0.7500 1.0000 0.9737 0.9605

1.0000 1.1250 1.1416 1.1464

1.2500 1.4062 1.4117 1.4121

1.5000 1.6875 1.6922 1.6922

1.7500 1.9688 1.9731 1.9731

2.0000 2.2500 2.2540 2.2540

2.2500 2.5312 2.5349 2.5349

2.5000 2.8125 2.8160 2.8160

2.7500 3.0938 3.0970 3.0970

3.0000 3.3750 3.3781 3.3781